Learn More About the Following Topics:

Background Information

Learning about how properties are currently used, how schools receive funding, population changes, and enrollment numbers provides helpful context for understanding the proposed alternatives in the Missoula County Public Schools (MCPS) properties plan.

How Buildings Are Used

The Properties Plan focuses on assessing and evaluating the existing properties and buildings themselves, not the MCPS programs or community partner programs housed in them. However, we recognized the importance of understanding how these buildings have been used historically and currently. We conducted learning sessions to gather and share this context with the Planning Committee.

Student Enrollment

Despite Missoula's population growth, MCPS enrollment is slightly declining at the elementary level. This reflects statewide and national trends of decreasing public school enrollment.

Montana funds schools based on enrollment through Average Number Belonging (ANB) - the official student count used for funding calculations. This number determines both state base aid and maximum general fund budgets. When enrollment stays flat or declines, districts face financial challenges.

Why this matters: Fewer students means less money, even if costs like building maintenance and utilities stay the same.

Source: Montana's largest school districts facing financial challenges

MCPS Growth Projections and Planning

One larger school of approximately 300-400 students is more cost effective than two smaller schools of 150-200 students each. One larger school requires approximately half the administrative and custodial positions as two smaller schools. There are reduced maintenance and utility costs associated with one building rather than two buildings.

Below are the capacities, 2025 enrollment, and forecasted 2032-33 enrollment for MCPS schools. Seeley-Swan High School is excluded to better illustrate the Missoula area high school capacity.

| MCPS Elementary School Capacity | |

| includes Chief Charlo, Franklin, Hawthorne, Jeannete Rankin, Lewis and Clark, Lowell, Paxon, Rattlesnake, Russell | |

| Capacity | 4,460 |

| 2025 Enrollment | 3,236 |

| Forecasted 2032-33 Enrollment* | 3,640 |

| MCPS Middle School Capacity | |

| includes C.S. Porter, Meadow Hill, Washington | |

| Capacity | 1,928 |

| 2025 Enrollment | 1,738 |

| Forecasted 2032-33 Enrollment* | 1,737 |

| MCPS High School Capacity | |

| includes Big Sky, Hellgate, Sentinel | |

| Capacity | 4,192 |

| 2025 Enrollment | 3,606 |

| Forecasted 2032-33 Enrollment* | 4,097 |

| *Missoula County Public Schools, MT Demographic Study Report: January 2023 | |

Note that the forecasted enrollments in the demographics study for 2025 do not necessarily align with current enrollment. For example, the elementary enrollment forecast for 2025-26 is 3,530 students and the current enrollment is 3,236.

Access the Demographic Study here.

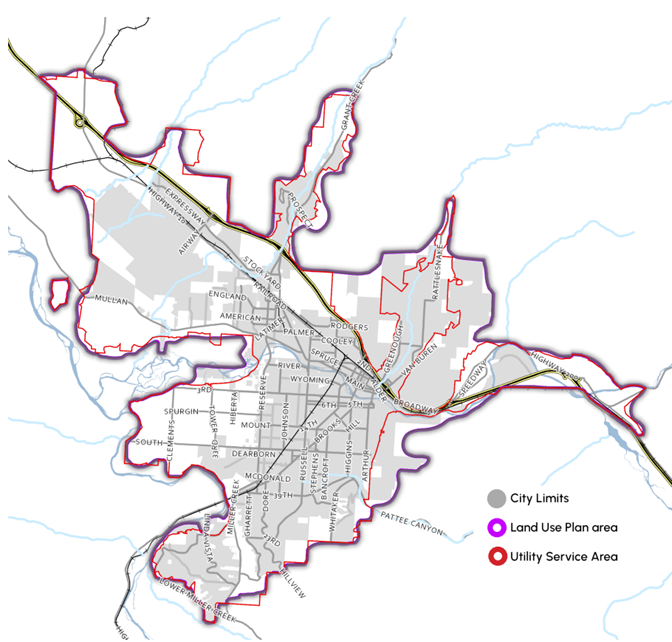

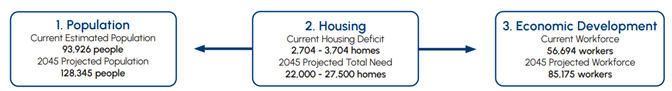

Growth projections for Missoula are included in the Our Missoula 2045 Land Use Plan. The current population for the Land Use Plan (LUP) Area is 93,926 people with a projection of 128,346 people by 2045. The LUP Area is shown on the map below. The LUP Area extends beyond the MCPS District, so some of the projected growth is planned to be accommodated by other school districts.

The MCPS Properties Plan is a separate process from the Our Missoula Growth Policy Update & Code Reform project. The MCPS Properties Plan will be approved by the MCPS Board of Trustees, and the Our Missoula Growth Policy Update and Code Reform will be adopted by the Missoula City Council. More information on Missoula Code Reform can be found here: Our Missoula | Engage Missoula

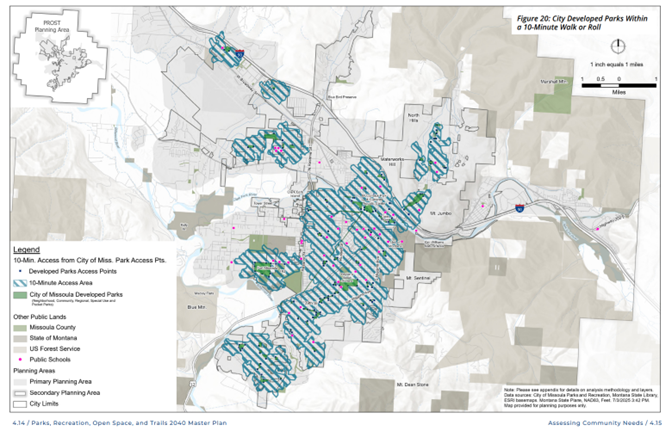

The City of Missoula Parks, Recreation, Open Space, and Trails Master Plan was recently updated. PROST Master Plan | Missoula, MT - Official Website

The figure below, City Developed Parks Within a 10-Minute Walk or Roll, illustrates gaps in geographic, systematic, and community access where additional developed parks are needed so everyone is within a 10-minute walk/roll of a park.

School Facilities Funding

Montana's public school facility funding has remained unchanged for over a decade:

- 44% state funding

- 27% local property taxes

- 12% federal funds

- 9% county funding

- 8% local non-tax sources

Why this matters: This model heavily relies on local taxpayers to cover infrastructure shortfalls when state and federal funding falls short.

Montana public schools face significant financial challenges:

Key Statistics:

- $141 million current budget shortfall

- $903 million estimated need to bring facilities to good condition (2008 report)

- $24 million cut from the Montana Facility Reimbursement Program in recent years

Recent School Levies

The May 2024 and May 2025 MCPS levies fund daily school operations for preschool through 12th grade schools, not the 14 non-school properties being evaluated in this plan.

What recent levies cover:

- General Fund Levies: Teacher salaries, classroom materials, daily operations for active schools

- Safety Levies: Security improvements, safety equipment, personnel for active school buildings

The key difference: Levies support ongoing operations of active schools. The current property planning process addresses buildings that serve other purposes or are no longer being used as traditional schools.

Levies fund day-to-day operations and programs that state funding doesn't fully cover for schools

Bonds cover building-related expenditures including infrastructure, technology, and building maintenance or renovations

Example: A levy might pay for teacher salaries this year, while a bond would pay for building a new gymnasium over the next 20 years.

Future School Buildings

The consultant team and planning committee evaluated all properties in the study for potential use as preschool through 12th grade schools. Properties were assessed based on size, access, and location requirements. Many were ruled out as unsuitable for school use.

The planning committee recognizes the need for a middle school in growing areas, particularly the Northside community. A possible recommendation may include acquiring land in the Northside for a future middle school, though no specific site has been identified.

Finance Terms Explained

An Educational Investment Fund uses proceeds from property sales or leases as principal for investments. Annual returns fund ongoing educational enhancements, ensuring property sales benefit students indefinitely rather than just once.

Example: If MCPS sold a property for $2 million and invested it at 5% annual return, it would generate $100,000 yearly for educational programs - forever.

A SID is a special tax district where property owners in a specific area pay for local infrastructure improvements or services. SIDs primarily:

- Create infrastructure

- Maintain facilities or services

The complete special improvement district statutes are available in Montana Code Annotated 7-12-4101 and 7-12-4201. Part 41. Special Improvement Districts - Table of Contents, Title 7, Chapter 12, MCA

The MSU Local Government Extension provides another description of SIDs. Scroll down to SIDs.

City Council creates SIDs through this public process:

- Resolution of Intent: Passed and advertised to notify affected residents

- Public Input: Citizens can protest and make public comments

- Final Resolution: Passed if protests are insufficient to cancel the project

Costs are paid through annual property tax bills, spread out over time rather than requiring a large upfront payment.